Compound Oracle Vulnerability Leads To $88m of Liquidations - Decentralise #37

What happened and why aren't protocols using Chainlink?

Here we go again. Another day, another faulty oracle.

This time it was Compound.

Compound now joins the oracle exploit hall of fame, along with Value and Origin this month.

The protocol had received criticism for using just one DAI price feed, Coinbase.

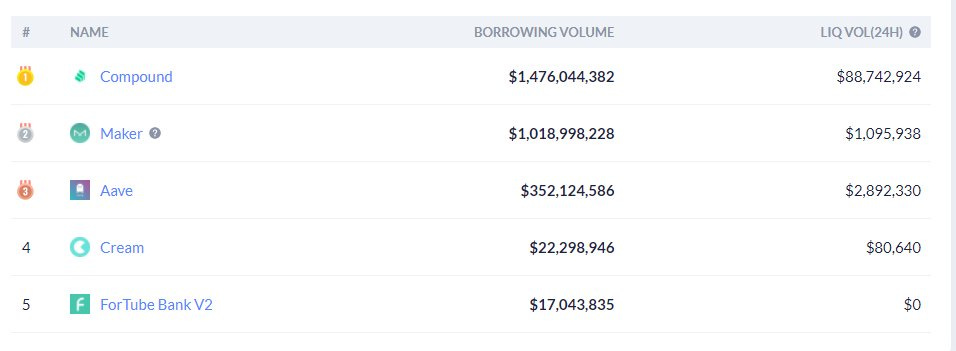

Today the limitation lead to users losing almost a hundred million dollars as the price of DAI spiked to $1.30 on this one exchange.

Members of the community found Compound founder Robert Leshner’s response lacking, which shifted the focus to users who “didn’t understand the risks” of their system’s design.

Perhaps it would have been better to not have had such a vulnerable design in the first place with $1.5b of assets on the platform.

Of the affected users $46m belonged to one individual, the third largest account on the platform.

Read Decrypt’s full analysis for a breakdown of what exactly happened.

Although DAI was temporarily $1.30 on Coinbase this price did not reflect the true price of the asset across the market.

Liquidated users have every right to be angry here, especially when an existing solution is easily available.

Chainlink protects from this sort of event by aggregating price feeds.

While Compound users were burned, Aave has been praised for protecting borrowers with Chainlink.

No Chainlink?

So why didn’t Compound use Chainlink despite members of the community having pointed out this exact vulnerability as far back as four months ago?

This has been an accident waiting to happen, especially inexcusable as Coinbase experienced a similar spike in the March Black Thursday calamity.

I’ve seen a few theories brought up, with speculation that some community members are too stubborn to admit their oversight, are bitter at missing LINK’s meteoric rise from $0.20 to $20.00 during a bear market, and are unwilling to be reliant on an external provider.

Conclusion

Whatever the reason, the reality is that building in-house decentralised, robust oracle systems is hard work.

This is Chainlink’s entire world, and they’re doing it well.

I really hope I don’t have to cover another oracle incident any time soon.

Watch this space.