yCredit Exploit

Earlier today a vulnerability was discovered in Andre Cronje’s recently unveiled yCredit which could lead to a total loss of user funds.

The medium post contained multiple warnings that yCredit was not safe and to not use it, but many ignored this advice and tracked down the contract.

The vulnerability was quickly confirmed by Yearn’s Emiliano and Banteg.

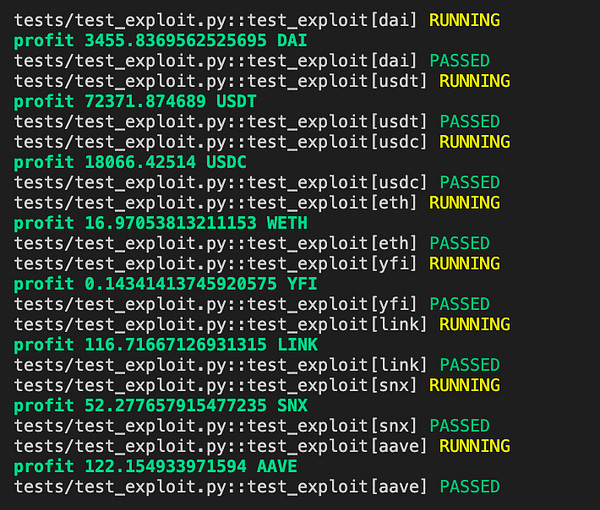

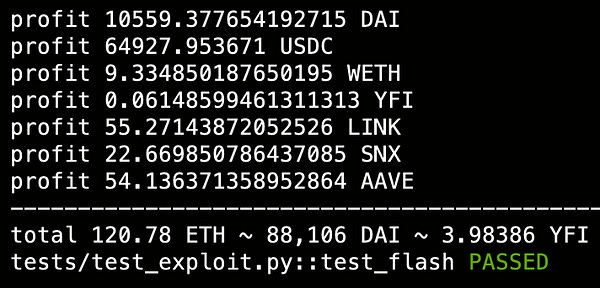

Banteg then managed to utilise an Aave v2 flash loan to test the vulnerability, which allows multiple assets to be borrowed.

It does not seem that the specific vulnerability has been used by an attacker, however a second and separate exploit was discovered to have happened just a few hours later.

yCredit

yCredit was unveiled in a Medium post from Andre on Thursday. It builds upon Stable Credit and allows users to deposit ERC-20s and receive a USD denominated credit line. A 0.5% fee is deducted and distributed to yCredit stakers. Arbitrage opportunities should incentivise a healthy peg.

Conclusion

Some in the community have shared concern that making unaudited and potentially unsafe code available, even when not advertised, is hurting Yearn’s reputation.

The event has brought discussions around the ‘test in prod’ approach back to the surface. As many users are committed to aping their funds into whatever the latest unaudited contract is, some are concerned it is damaging Yearn’s reputation.

yCredit was explicitly not intended for public use, with multiple warnings and no UI - users had to go out of their way to ape in.

I absolutely agree with Banteg that DeFi users’ behaviour is getting ridiculous.

We’ve had several instances where people have lost funds with this reckless strategy, but greed seems to outweigh caution time and again. It is to some extent understandable - those who aped into KP3R certainly didn’t regret it.

I’m against users losing money, but Andre’s approach is well documented and brings benefits that he swears by. If apes are willing to risk funds gambling they certainly have no one to blame but themselves.

Whether this is damaging Yearn’s reputation however is another matter entirely.

Decentralise is sponsored by PieDAO, community governed tokenised ETFs. YPIE PieVault is a brand new product type, maximising yield while giving diverse exposure to the Yearn Finance Ecosystem.