🚄 Optimism Mainnet

Optimism have launched their mainnet, exponentially scaling Ethereum with L2.

The team have dubbed it a soft launch with ‘training wheels’ and will progressively add features over time.

Optimism is the first L2 to allow full support for L1 smart contracts, allowing DeFi protocols to fully port over to a fully scalable and secure ecosystem.

🥧 PieDAO

Decentralise is sponsored by PieDAO, the community governing tokenised ETFs.

PieVaults are a new product range, diversified yield aggregators capable of multiple farming strategies. The first PieVault YPIE gives complete exposure to the Yearn Finance Ecosystem.

⚔️ Synthetix Staking on L2

Synthetix are the first to begin porting operations to Optimism’s L2, with SNX stakers now able to migrate.

A full migration is scheduled to take place over the next few months.

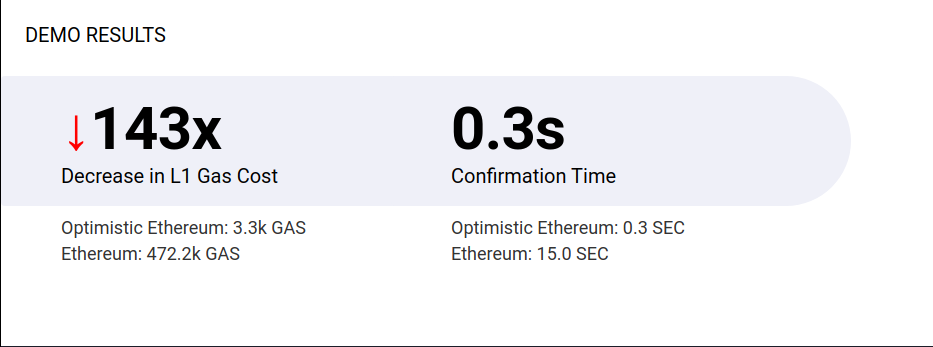

The Synthetix Optimism demo showcased the enormous benefits:

Read the full migration roadmap from Kain Warwick here.

💰 Yearn v2 Vaults

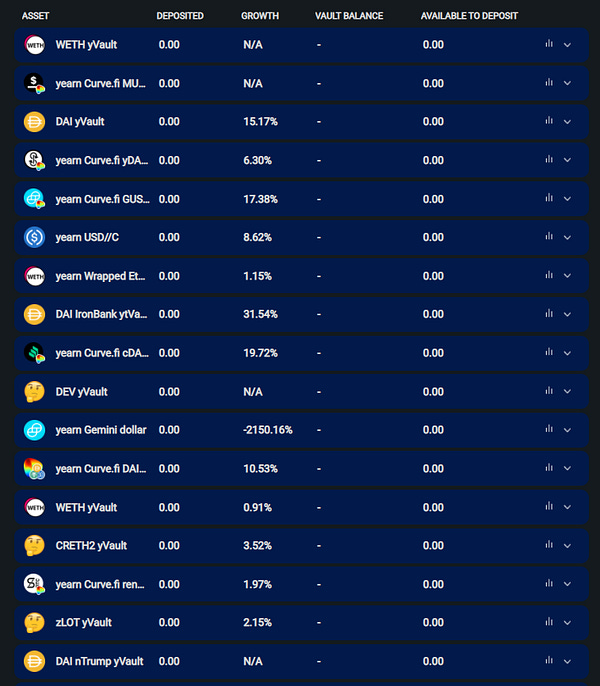

Yearn Finance have launched v2.

The front-end is currently being finalised, but you can see a list of the new vaults here.

The community has also been exploring ways to reward developers, who have been working without a clearly defined incentives mechanism and personally fronting the high gas costs of operations.

While discussions are ongoing, Onlylarping has kick-started direct action by announcing a 20 YFI donations matching, allocating 1 of his personal YFI for the first 9 donated from the community, and 1 for every subsequent 99 thereafter.

Support Yearn developers by donating YFI to the multisig ychad.eth.

A Snapshot is also polling YIP-56, which would replace YFI staking with a buyback model.

🏦 Cream Finance Introduce Iron Bank

Previously known as Cream V2, the Iron Bank is being developed with Yearn Finance.

The Iron Bank will be a protocol-to-protocol lending platform and liquidity backstop for the entire DEFI ecosystem.

It will enable zero-collateral loans using a credit system.

Only whitelisted protocols will be able to participate, raising security.

In combination with Yearn vaults and Alpha Homora high-leveraged farming will be possible (up to 90x on stablecoins or 80x ETH).

💲Curve Metapools

The new pool factory will let anyone deploy Curve Metapools, just as anybody can create pools with Uniswap.

The release has been a collaboration with Yearn Finance, with the announcement video linking to crv.finance.

Previous Newsletter:

YFI Buyback, EIP-1559 Updates, and Badger V2

Decentralise is sponsored by PieDAO.

Join the PieDAO community.