📰 Decentralise Daily #93

Decentralise Daily is the daily DEFI newsletter breaking down the latest news and developments.

DEFI (Decentralised Finance) is a revolutionary movement built on Ethereum providing open financial tools for a global audience.

The space moves at lightning pace, so subscribe to get the latest news and market highlights direct to your inbox.

📊 Market Highlights:

🥒 Pickle Finance Announce DILL

Pickle Finance have announced that DILL has passed multiple audits and will be implemented shorty.

DILL has been a collaboration with Yearn Finance and will be implemented on the platform in the near future. The announcement and retweet from Andre Cronje sent PICKLE up over 30%.

Investors will be able to lockup their PICKLE tokens for up to four years in order to receive boosts to yield farming vaults. DILL is a non-tradable token given in exchange for locked PICKLE, allowing those who lock to continue to participate in governance.

Pickle also recently announced a Smart Treasury which will divert fees generated from the protocol to a PICKLE / ETH Balancer smart pool, adding constant buying pressure to the PICKLE token and serving as a war chest to fund community initiatives and development.

The recent BAC / DAI and MIC / USDT farms have seen a huge increase in TVL for the protocol, with investors attracted by upwards of 60,00% predicted APY due to automatic compounding.

🥧 PieDAO

Decentralise is sponsored by PieDAO, the community governing tokenised ETFs.

PieVaults are a new product range, diversified yield aggregators capable of multiple farming strategies.

The first PieVault YPIE gives complete exposure to the Yearn Finance Ecosystem.

Alpha Finance v2 Explained

Ahead of the upcoming v2, Alpha Finance have produced a recap of how they allow leveraged yield farming.

Farmers will be able to access up to 9x leveraged yield farming positions on Balancer, Uniswap, Sushiswap and Curve.

Alpha Finance now has over $500m TVL.

The collaboration with Cream and Yearn known as the Iron Bank will allow zero collateral protocol-to-protocol lending enabling up to 90x leverage.

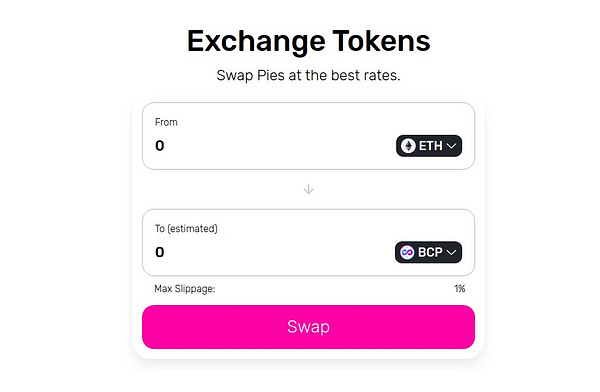

🥧 PieDAO Exchange

PieDAO have launched an exchange.

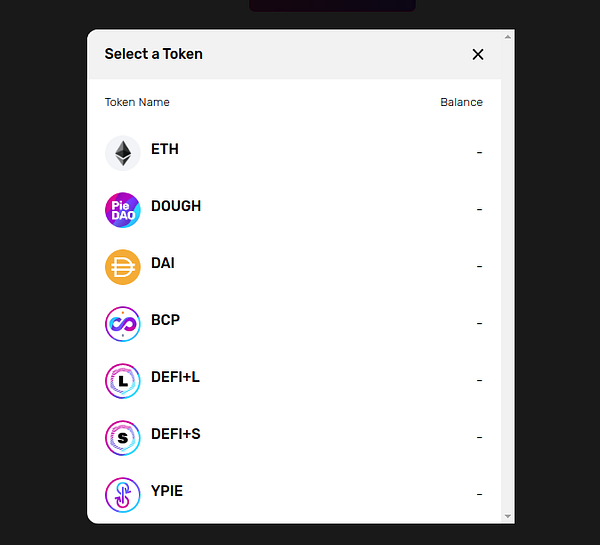

Now users can easily swap between pies, ETH and DAI directly from the PieDAO site.

The exchange uses 0xProject’s relayer to guarantee the best market price, integrating with Balancer, Uniswap, Sushiswap and more.

PieDAO’s PieVaults are ramping up, combining diversification with multiple active yield-generating strategies.

The Yearn Ecosystem PieVault is already live, and the community are discussing a DEFI PieVault containing YFI, AAVE, SUSHI and SNX.

A USD stablecoin PieVault is also being discussed.

🗞️ Previous Newsletter:

🦡 BadgerDAO DIGG Rebase, Chainlink Guide and ETH Network Growth

Decentralise is sponsored by PieDAO.

Join the PieDAO community.