Understanding Yearn's Acquisitions - Decentralise #39

Andre Sheds Light on Integrations with Pickle, Cream and Cover

Andre Breaks it Down

A few hours ago Andre Cronje put out a blog attempting to clarify Yearn’s recent platform integrations.

The project has shocked the defi space by announcing collaborations with Pickle, Cream, and Cover all within just a few days.

The moves rapidly expand the already large Yearn ecosystem, providing Pickle’s existing and future farming strategies, Cream’s borrowing, lending and leveraged yield, and Cover’s permissionless defi coverage.

I wasn’t the only one to point out that the Yearn official content, core devs, and community have all been using the terms acquisition, merger, and collaboration pretty much interchangeably.

Today Andre addressed the issue directly.

Mergers, Acquisitions, or Collaborations?

All three of these words have different meanings in traditional finance with different connotations pertaining to both ownership and power.

Today Andre broke down the terms, how they apply to what’s happening, and how none of them are directly applicable.

From Andre’s blog:

merger: a combination of two things, especially companies, into one.

acquisition: an asset or object bought or obtained.

partnership: an association of two or more entities as partners.

collaboration: the action of working together to produce something.

Everyone should definitely check out his full explainer, but the reality is that no one really knows how applicable they are to Yearn. What’s happening here is entirely unprecedented, and we don’t have the vocabulary to explain it accurately.

What is clear is that all three mergers are different.

Pickle

Here the development teams have combined in what Andre describes as a merger of human talent. Pickle will deploy their new and existing strategies as V2 vaults. While Pickle and Yearn devs will now work together, share resources, expertise, and ecosystem advantages, the two will remain distinct brands with individual communities.

Cream

Although the development teams have merged here, Andre differentiates this integration as two distinct teams working together towards a common goal. He calls it a collaboration and partnership. As we know from the announcement blog, Yearn will integrate a lite version of the platform that only allows blue chip tokens as collateral.

Cover

Here Andre states that what’s happening relates closely to the deal with Cream. Yearn will offer security, review and shared audits, and will integrate elements of Cover’s system into Yearn, using YFI as the backbone token. The merger can be seen again as two distinct teams aligning goals and outcomes.

This might all sound a little vague, and that’s partly because we just don’t have the terminology to describe what’s happening. They’re not mergers or acquisitions, as all three the projects are left with varying levels of autonomy. Nor are they equal parties partnering or collaborating, as there are certainly power dynamics here.

Decentralised Governance

Although external commentators have raised the issue that YFI holders had no say in these moves, Yearn core devs have been very clear about where they stand.

Andre has publicly stated multiple times that Yearn’s governance token YFI has zero value and that these tokens are largely ponzi schemes.

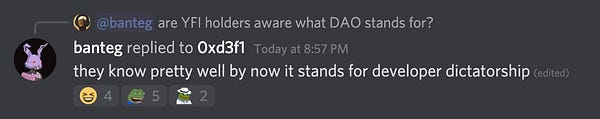

Here’s another insight from core dev Banteg.

Instead, they place a focus on building robust protocols that are permissionless, censorship-resistant and efficient.

I remain optimistic about the future of decentralised governance, but Yearn’s transparency around where power truly lives right now is quite refreshing. It’s likely that I’m happier to make this allowance purely because of the incredible work Yearn is doing providing quality financial tools, innovating, and providing leadership.

As we all know, decentralised governance is a long way from perfection. We’ve seen multiple issues at Maker and low participation at Uniswap has prevented votes reaching the required quorum, stifling potential progress.

Synthetix are also moving towards a council system, with SNX holders electing representatives.

I’m happy to see talented developers exploring alternative avenues, prioritising development, features, security and censorship-resistance.

Conclusion

Yearn’s integrations are completely unprecedented, and none of the announcements directly relate to established practices in the corporate world. We don’t yet fully know what the recent news means for either Yearn or the future of each project.

What is clear is that the Yearn ecosystem is quickly becoming a defi powerhouse.

I’m expecting this ecosystem to massively expand in the coming years.

That’s all for today, but don’t forget to subscribe to Andre’s blog, as well as the other key Yearn publications: