Uniswap Grants Program Passed

Uniswap’s third vote has passed, approving the Uniswap Grants Program.

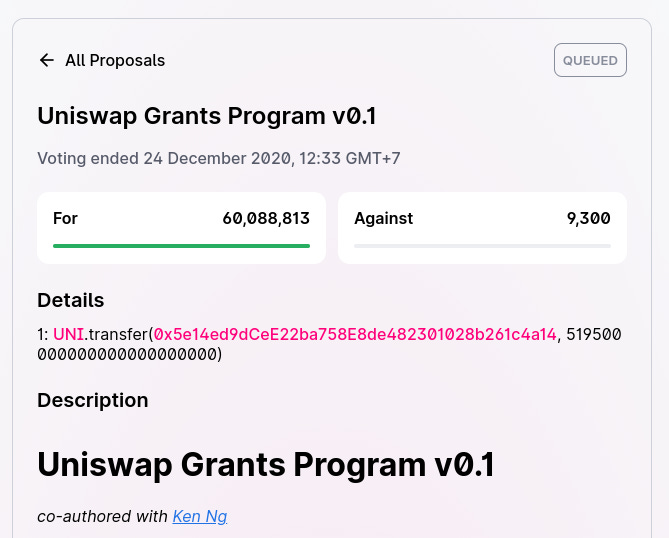

The 40M UNI minimum quorum that had previously proved to be a stumbling block was broken, with the vote ending on the 24th with over 60M ‘for’ votes.

The grants program will initially see $750k of funding available each quarter to build out the Uniswap ecosystem, a figure that can be reassessed every six months.

The proposal is now queued for 24 hours, and there hasn’t been an official announcement from the team or Hayden.

Following the proposal Kenneth Ng will take the lead as grant coordinator, the only paid position. Kenneth has played an integral role coordinating the Ethereum Foundation Grants Program over the last two years, and was also the main reason Uniswap initially received funding in 2018.

There will also be five unpaid reviewers:

Jesse Walden Founder and Investor at Variant Fund

Monet Supply Risk Analyst at MakerDAO

Robert Leshner Founder and CEO of Compound Finance

Kain WarwickFounder of Synthetix

Ashleigh SchapGrowth Lead, Uniswap (Company)

Conclusion

The proposal suggests starting small with sponsored hackathons, developer incentives and bounties. Over time the aim is to scale this, working up to improved frontends and core protocol development.

$750k quarterly is a significant chunk of change, and I’m pleased to see the ecosystem growth and community engagement being prioritised. It’s also great to see Uniswap’s governance operating effectively with a clear consensus in the community on this proposal.

Uniswap has had a monumental impact on DeFi both with their product and their fair launch, and the protocol commands 54% of all DEX volume.

I hope to see the UGP efficiently grow-out the ecosystem, and Kenneth’s expertise in this area is a fantastic asset to the protocol.

Decentralise is sponsored by PieDAO, community-governed tokenised portfolios. You can gain balanced exposure to UNI and other leading DeFi protocols with DeFi+L.