Forging Ahead

Img Taken from Dune Analytics

It’s been a busy week for Yearn.

Then again, what isn’t a busy week for the community behind DeFi’s leading suite of tools?

To keep up I recommend subscribing to the Yearn Finance Newsletter, the State of the Vaults Medium, and the platform’s Twitter.

I’m just going to talk about a couple of the highlights here.

Looking at the numbers this week it’s pretty remarkable. Yearn.finance currently manages $532m from which it generates an estimated $36m (7.5%) annually.

Despite this, the YFI token is currently priced at $10,444 with a $312m market cap.

v2 yVaults: Pickles, Unicorns and Cream

Putting that to one side, the big news this week is that the community launched three of the eagerly awaited v2 yVaults:

UNI-WBTC-ETH

UNI-DAI-ETH

yvCRV

The first two tap into Uniswap and Pickle Finance, continually using profits to purchase liquidity pool tokens and automatically reinvest. The third vault yvCRV has a similar approach but using C.R.E.A.M.

How do they work?

In the WBTC and DAI strategies users deposit their LP token of choice which are then put to work on Pickle, earning both UNI and Pickle tokens. Uni tokens are automatically reinvested into the Uniswap LP token, and Pickle tokens are periodically sold and reinvested for Pickle LP tokens.

A new strategy has been identified already that could reinvest Pickle rewards to farm WETH rewards, tapping into the latest development from Pickle.

You can find the vaults here.

As a big fan of the Pickle community it’s pretty exciting stuff, but hold your pickle!

What’s that, you aped in before finishing reading? Sigh.

WARNING: These vaults have not been audited and you could lose everything. A cap of $100k has been set for now, and issues have already been identified.

Community Funding

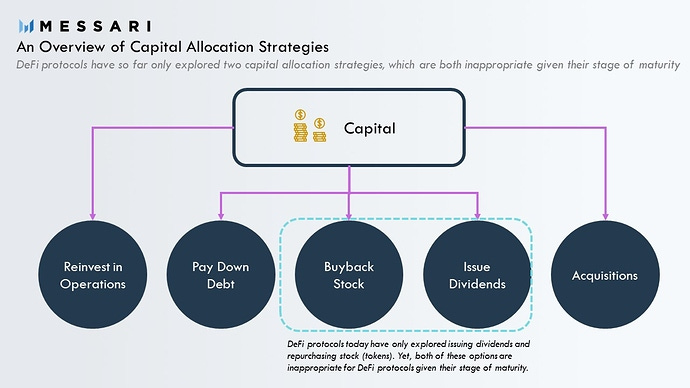

In other Yearn news there was a community funding proposal from Ryan Watkins.

Tl;dr: Stop rewarding stakers with yCrv/yUSD. Start using the funds to buy YFI, use the YFI to fund community grants.

There’s lots to unpick here, but I’ll keep it short. Ryan references a few data points that indicate the proposal would be a more efficient use of capital for the growth of the platform. The funds could be used to incentivise not just developers but proposal writers, strategists, content creators and liquidity providers, and Ryan stresses that this could be a temporary measure for the short term.

The proposal has kick-started a healthy debate on the forum with many community members showing support, and several requesting a more data-focused and less open-ended proposal.

The community have currently signalled in favour with 70% approval and 220 votes.

Wrapping Up

This is just a choice selection of the latest from Yearn. To get the full update head over to the official newsletter. There’s loads to learn, including some details about Andre’s very exciting Keep3r Network.

Join the community funding debate, and don’t forget to get involved in the community discord.